Cash App offers an overdraft option similar to banks and other cash advance apps. However, it may lead to a negative balance due to factors like temporary hold on accounts by online retailers and restaurant charges like tips.

Users should be aware of these issues when adding additional charges that exceed the account’s available funds. Cash App also provides an overdraft option for users to borrow money from the app.

Therefore, it is crucial for users to be aware of potential negative balance issues.

How do I Overdraft my Cash App Account?

To overdraft your Cash App account, you would need to make a purchase that creates a delayed transaction or secondary charge. You could then continue to make purchases until you have a negative balance.

However, There is no direct way to overdraft your Cash App account. However, there are two ways that you can create a negative balance in your Cash App account:

Delayed transactions

When you make a purchase with Cash App, the funds are typically deducted from your account immediately. However, in some cases, the transaction may not be processed for a few days.

If you make another purchase before the first transaction has been processed, it may create a negative balance in your account.

Secondary charges

Some merchants may charge you additional fees after you have made a purchase. For example, if you rent a car using Cash App, the rental company may charge you a late fee if you return the car late.

These secondary charges can also create a negative balance in your account.

In conclusion, It is important to note that overdrafting your Cash App account can have negative consequences. For example, you may be charged a fee for each overdraft, and your account may be suspended until you repay your balance.

Read more here:

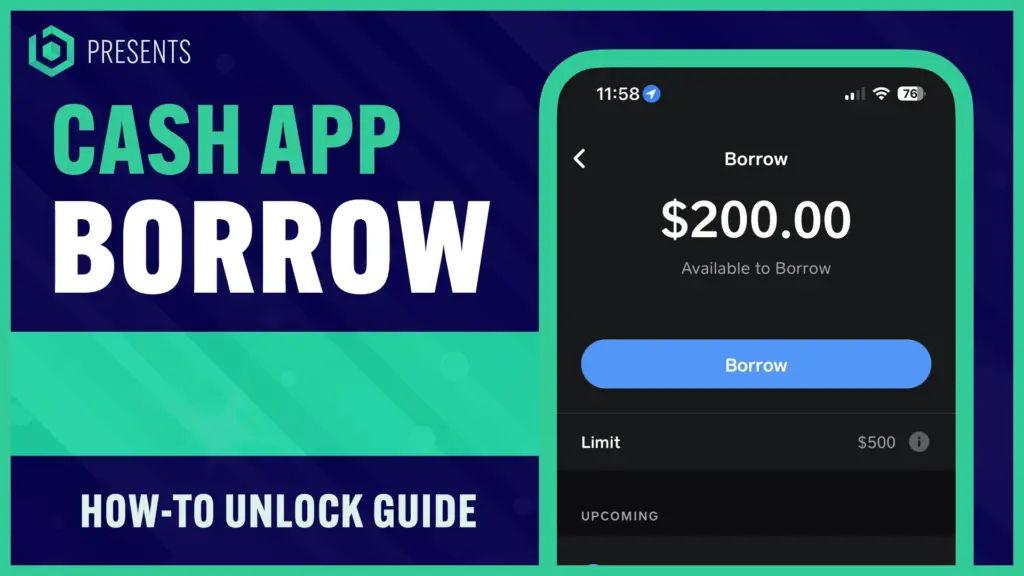

How to Get The Borrow Option on Cash App?