Dave Ramsey is one person who keeps things straightforward. Both his baby steps and other guidelines (such as how much house you can afford) are simple to understand.

In this article, we are going to look at how we can apply the Dave Ramsey Budget Ruleto to have a very good financial life.

You can read What is the Dave Ramsey Budget Rule for more understanding.

How to Apply the Dave Ramsey Budget Rule

To effectively apply the Dave Ramsey Budget Rule, follow these detailed steps:

Step 1- Calculate Your Total Monthly Income

Include all sources of income, such as salaries, bonuses, side hustles, and any other earnings even earnings from your side hustles after deducting your tax.

This would ensure accuracy in your budgeting.

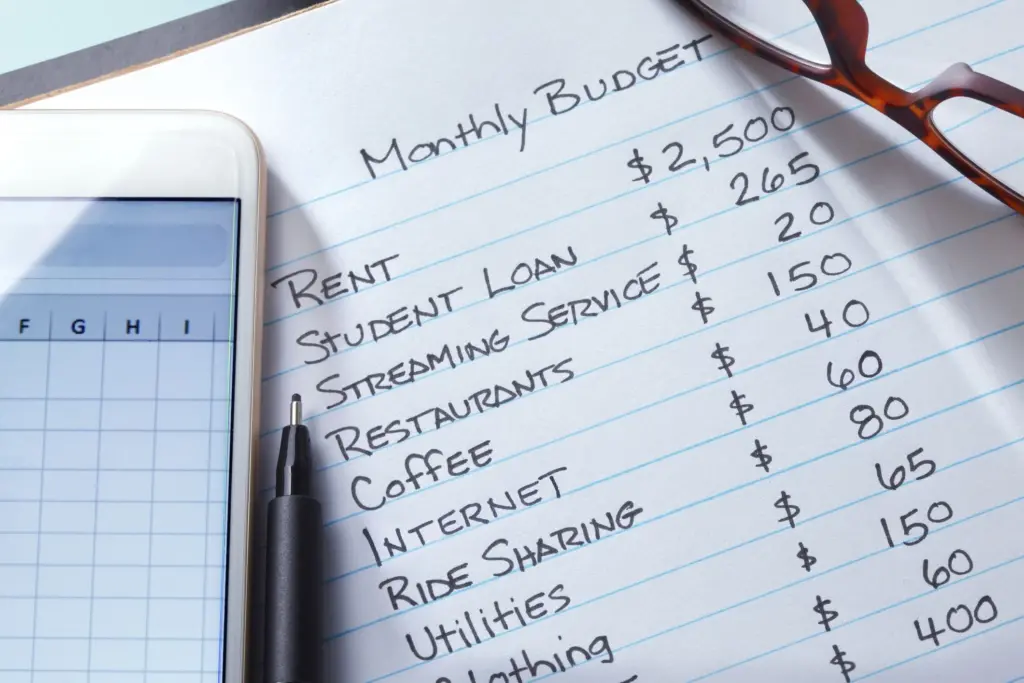

Step 2- List All Expenses

You can start with essential fixed expenses like rent or mortgage, utilities, insurance premiums, and loan payments, and even your Netflix subscription.

The expenses can be grouped into fixed, variable, and irregular expenses.

Step 3- Categorize Your Expenses

You can start by allocating funds for essential needs like housing, utilities, groceries, and debt repayment.

You start to see what could be taking up too much of your money and what you might adjust when you break your budget down into sections.

You might need to change certain categories or add new ones (childcare, debt repayment, medical expenses, etc.) according to your situation.

Step 4- Track Your Spending, Review and Adjust

Monitor your expenses regularly to stay within your budget limits. For this, you can use budgeting tools or apps to track spending and identify areas where you may need to adjust.

With this, you may close the gap between your actual spending and your budget goals by keeping track of your expenditures.

Key money habits that can help you gradually accumulate wealth and achieve financial stability include keeping a close eye on your finances, saving money, avoiding debt, and spending less than you make.

Now that we know about how to apply the Dave Ramsey Budget Rule let us look at some real-life applications.

Real-life application of the Dave Ramsey Budget Rule

Let’s say you earn $3,000 per month after taxes and you would want to apply the Dave Ramsey Budget Rule, your expenses might include:

- Rent: $1,000

- Utilities: $200

- Groceries: $300

- Transportation: $150

- Debt payments: $200

- Savings: $500

- Miscellaneous expenses: $250 Total Expenses = $1,000 + $200 + $300 + $150 + $200 + $500 + $250 = $2,600 Remaining income = $3,000 – $2,600 = $400

- Allocate the remaining $400 to savings, emergency fund, or paying off debt until it equals zero.

If you have any questions about how to apply the Dave Ramsey Budget Rule leave them in the comment section and I will be very happy to answer them for you.

To conclude you should bear in mind that whether you are saving for a vacation, buying a car, or investing in education, allocate funds toward your goals within your budget.

You should break down larger goals into smaller, manageable amounts and incorporate them into your monthly budget until you reach your target.