Planning for monthly expenses and reaching your financial objectives may both be facilitated by creating a budget for your personal financial management. Selecting a method, like the 50-20-30 rule, is a crucial first step in giving your budgetary goals shape.

It’s crucial to keep in mind that this approach offers several benefits if you’re still learning how to make a budget. Despite the advantages, if you’re not committed, this approach might not be right for you.

In this article, we will talk about what the Pros and Cons of the 50 30 20 Budget are.

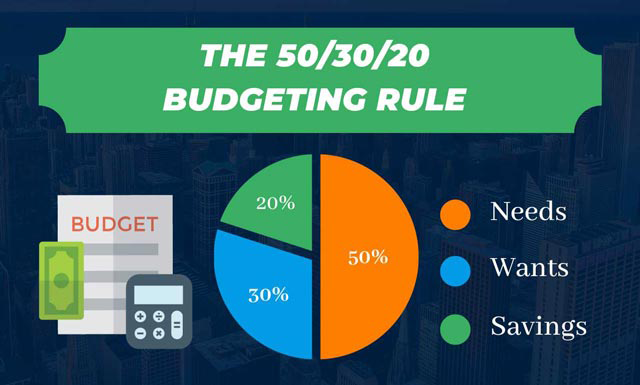

Elizabeth Warren, a senator and potential presidential candidate, popularized the 50/30/20 rule. To put it simply, here is how it functions: Each month, you take your after-tax income and split it as follows:

50% goes for necessities (housing, food, utilities, insurance, minimal bill payments, etc.).

30% is spent on desires (new clothing, vacations, tickets to concerts, nights out, etc.).

20% for savings (retirement, over-the-minimum debt payments, down payment on a house, etc.)

Pros for the 50 30 20 Budget

These are some of the benefits of the 50 30 20 Budget I have experienced

1. This budgeting process is enough to help you achieve your objectives.

It can also assist you in saving money for retirement or a trip. To reach your objectives, you should raise your savings rate if your income is large.

However, it’s not the ideal option for people who wish to make long-term savings. For everyone, the 50/30-20 technique is a wonderful place to start. You are not permitted to spend more than 50% of your monthly revenue on non-essentials while using this strategy.

2. Helpful for debt repayment

The 50-20-30 guideline might be helpful for people who have purchased a home or vehicle or who have a lot of student loan debt. You may start saving money and enjoy other financial benefits by paying off these obligations.

For instance, you may improve your credit score and reduce your credit card debt by allocating 20% of your monthly income to debt repayment.

3. It’s easy to use the 50-30-20 budgeting strategy.

Making a budget might seem difficult and complex. Rather, there are just three areas of spending that need to be considered. After dividing your revenue across those three areas, you check to see if you’re on track.

Cons for the 50 30 20 Budget

These are some of the problems with the 50 30 20 Budget I have experienced

1. Not helpful for people who earn a low income:

One reason is that it may require more than 50% of their income to meet their demands.

It’s possible for low-income households—particularly those in pricey cities—to have to spend more than half of their after-tax income on necessities. You might try looking for more inexpensive homes or haggling over prices for necessities.

However, if your home is similar to many of them, you have probably already made as many cuts to your budget as you can, and you still spend over half of your income on essentials.

2. The 50 30 20 Budgetdoes not give paying off debt priority:

You probably want to pay off your debt as quickly as you can if you’re managing it. The 50-30-20 budget limits the speed at which you may complete this.

You may only allocate 50% of your income, including debt repayment, to fixed critical expenditures while using this budget strategy. If this is essential to you, you might want to change it.

3.The rule emphasizes desires.

You will never succeed financially if you prioritize your wishes. Right now, you may need to make budgetary concessions, and that’s acceptable. Later, it will all be worthwhile.

If you stick to the 3 Baby Steps I described at the start of this article, you will eventually have enough money to live and donate like no one else.

I would advise you to put in the effort now so that you may allocate your funds as you see fit in the future.