FICO® score is the VIP guest list for your financial dreams. FICO stands for Fair Isaac Corporation, the company that gave birth to this widely used credit scoring model.

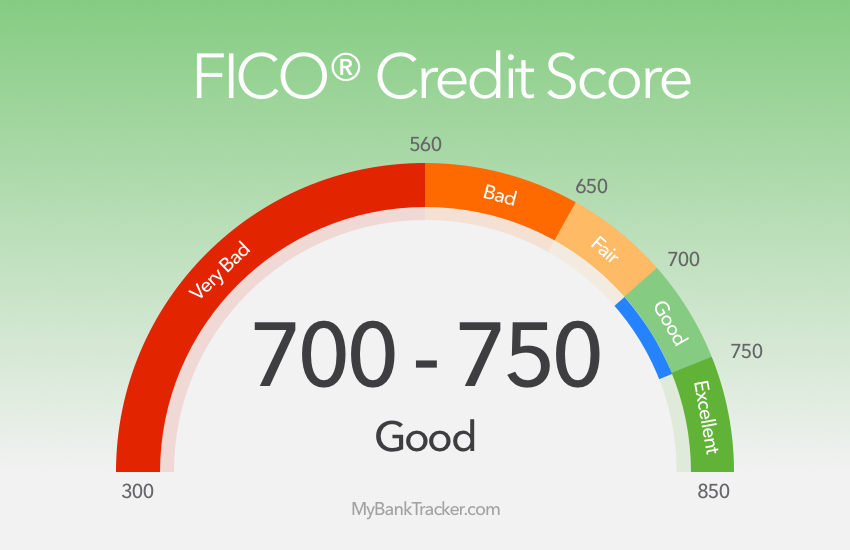

Your FICO score is a three-digit number that represents your creditworthiness. It’s derived from the information in your credit report and serves as the gatekeeper to your financial opportunities.

FICO® Score Factors

Your FICO score is a blend of five critical factors, each carrying a different weight:

1. Payment History

The most influential factor, your payment history, looks at your track record of making on-time payments. Late payments, collections, and defaults can drag your score down.

2. Amounts Owed

This factor considers the amount you owe, including credit card balances and other outstanding debts. High balances relative to your credit limits can negatively impact your score.

3. Length of Credit History

The age of your credit accounts matters. A longer credit history demonstrates your ability to manage credit over time.

4. Credit Mix

Lenders like to see a mix of credit types, such as credit cards, installment loans (like mortgages or car loans), and retail accounts.

5. New Credit

Opening several new credit accounts in a short period can negatively affect your score. Lenders may view it as risky behavior.

Why These Factors Matter

Loan Approval

Lenders use your FICO score to decide whether to approve your loan application. A good score increases your chances of getting approved.

Interest Rates

Your FICO score plays a significant role in determining the interest rate on your loan. Higher scores generally mean lower rates, saving you money over time.

Credit Card Offers

Credit card issuers evaluate your FICO score when deciding whether to approve your application and set your credit limit. A good score can lead to better credit card offers.

Renting an Apartment

Landlords may check your credit score to assess your financial responsibility. A good score can help you secure your desired rental.

Insurance Premiums

Some insurance companies use credit scores to calculate premiums. A good score might translate to lower insurance costs.

More Contents on Credit Score

The Complete Guide to Understanding Credit Scores

Why Having a Good Credit Score Is Important

Why There Are Different Credit Scores

What Affects Your Credit Scores?

How Do I Improve My Credit Score?

Where Can I See My Credit Score?

What Credit Score Do I Need to Buy a Car?

Can You Get a Car With Bad Credit?

What Credit Score Do I Need to Get a Good Deal on a Car?

Why Is a Credit Score Important When Buying a Car?

What to Do if You Don’t Have a Credit Score

Monitor Your Credit Report and Score

Improving your FICO score or maintaining a good one takes time and responsible financial management. Take the following steps in order to improve your credit score.

Pay your bills on time consistently.

Keep your credit card balances low relative to your credit limits.

Avoid opening too many new credit accounts at once.

Keep old accounts open to maintain a longer credit history.

Review your credit reports for errors and dispute any inaccuracies.

To summarise, your FICO score is the conductor of your financial orchestra, bringing the notes of your credit history into harmony.

Understanding the FICO score variables enables you to create a financial masterpiece, opening the door to better chances and favorable terms.