The phrase “FICO score” is frequently used. You’ve probably heard of it when talking about loans, credit cards, or even renting a flat. But what exactly is a FICO score, and why is it so important in your financial life?

FICO credit scores, which are utilised in 90% of mortgage applications in the United States, assess an individual’s creditworthiness.

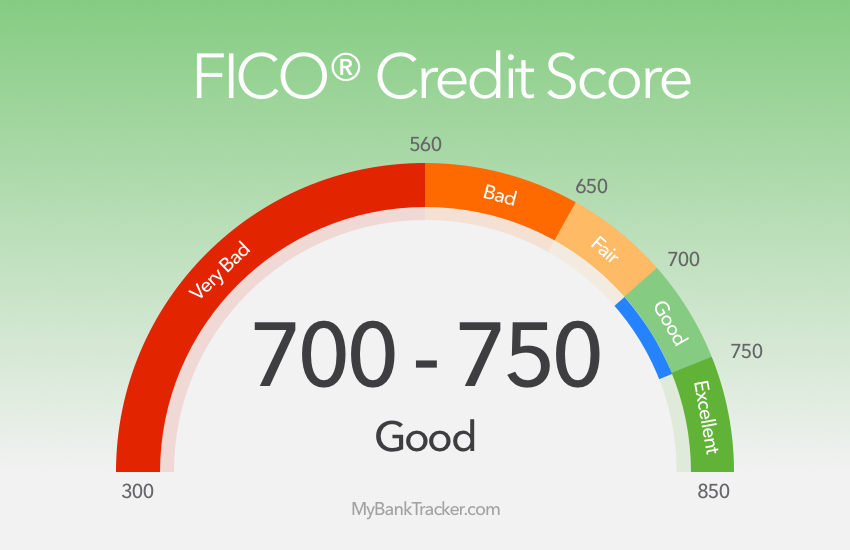

Scores ranging from 670 to 739 are considered good. Improving FICO ratings necessitates on-time bill payments, minimal credit usage, and a variety of credit options.

What Is a Good FICO® Score?

FICO is an abbreviation for Fair Isaac Corporation, the business that created the widely used credit scoring methodology.

FICO scores are three-digit numbers that represent your creditworthiness and are calculated using information from your credit record.

It assists lenders in determining the risk of lending you money and the terms of credit given to you.

FICO scores range from 300 to 850 and are categorized into five levels: Poor (300-579), Fair (580-669), Good (670-739), Very Good (740-799), and Excellent (800-850)

Lenders consider poor credit scores to be high risk, whereas fair credit scores may qualify for credit but result in higher interest rates.

More Contents on Credit Score

The Complete Guide to Understanding Credit Scores

Why Having a Good Credit Score Is Important

Why There Are Different Credit Scores

What Affects Your Credit Scores?

How Do I Improve My Credit Score?

Where Can I See My Credit Score?

What Credit Score Do I Need to Buy a Car?

Can You Get a Car With Bad Credit?

What Credit Score Do I Need to Get a Good Deal on a Car?

Why Is a Credit Score Important When Buying a Car?

What to Do if You Don’t Have a Credit Score

Monitor Your Credit Report and Score

The Significance of a Good FICO Score

A good FICO score is crucial for various reasons, including loan approval, interest rates, credit card offers, and renting an apartment.

Lenders use your FICO score to approve loan applications, and higher scores generally lead to lower interest rates. Credit card issuers also evaluate your FICO score, and a good score can result in better offers.

Additionally, a good FICO score can help secure desired rental properties.

To retain a decent FICO score, make consistent bill payments, keep credit card balances low, avoid opening many accounts at once, keep old accounts active, and examine credit reports for inaccuracies and disputes. These tactics will assist you in improving your credit history and overall financial wellness.

To summarise, a good FICO score can serve as a financial standard, resulting in more favourable prospects, reduced lending rates, and a smoother road to financial goals. Grow your FICO score intelligently to open doors to a better financial future.