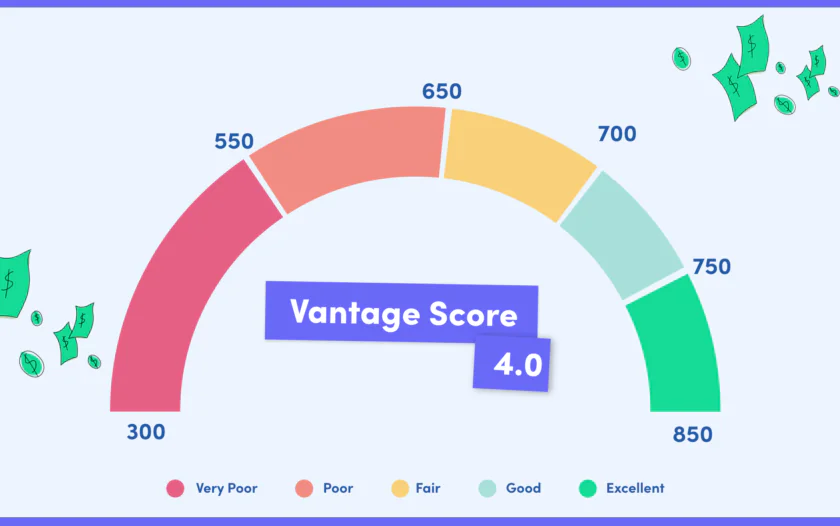

VantageScore is a credit rating methodology developed collaboratively by Equifax, Experian, and TransUnion. This score, like the FICO score, is a numerical representation of your credit history.

Your VantageScore is a three-digit score used by lenders to determine your creditworthiness. It is determined by a number of criteria, including your payment history, credit utilisation, credit history length, fresh credit inquiries, and credit mix.

The VantageScore is crucial for loan approval, interest rates, credit card offers, renting an apartment, and insurance premiums.

A strong score increases approval odds, lowers rates, and leads to better credit card deals. Higher scores also help landlords secure preferred rentals and insurers calculate premiums, resulting in lower costs.

VantageScore Factors

The five Factors that influence your VantageScore are as follows:

Payment history

This is the most essential factor, accounting for roughly 40% of your overall score. Lenders want to see that you have a track record of making on-time payments.

Credit utilisation

This is the amount of credit you are currently using in comparison to the total amount of credit available to you. Lenders prefer to see that you are just using 30 percent of your available credit.

Credit history length

Lenders prefer to see that you have a long history of appropriate credit use. The more credit history you have, the better.

New credit inquiries

A high number of new credit inquiries on your credit report is not something that lenders like to see. This may suggest that you are requesting a lot of credit, which may be an indication that you are having financial difficulties.

Lenders prefer it when borrowers have a range of credit accounts, including credit cards, installment loans, and mortgages. This demonstrates your capacity to handle various forms of credit.

More Contents on Credit Score

The Complete Guide to Understanding Credit Scores

Why Having a Good Credit Score Is Important

Why There Are Different Credit Scores

What Affects Your Credit Scores?

How Do I Improve My Credit Score?

Where Can I See My Credit Score?

What Credit Score Do I Need to Buy a Car?

Can You Get a Car With Bad Credit?

What Credit Score Do I Need to Get a Good Deal on a Car?

Why Is a Credit Score Important When Buying a Car?

What to Do if You Don’t Have a Credit Score

Monitor Your Credit Report and Score

In conclusion, Your financial well-being greatly depends on your VantageScore. You can take measures to raise your score by being aware of the variables that influence it.

You can save money in the long term by getting approved for loans and credit cards with reduced interest rates if you have a high VantageScore.