A credit score is a three-digit number that lenders to determine a person’s creditworthiness. This basically measures of how likely a person is to repay borrowed money to the lender. Organizations that lend out money such as banks, credit card companies, and other financial institutions, use the credit score to determine the risk in lending out money to an individual.

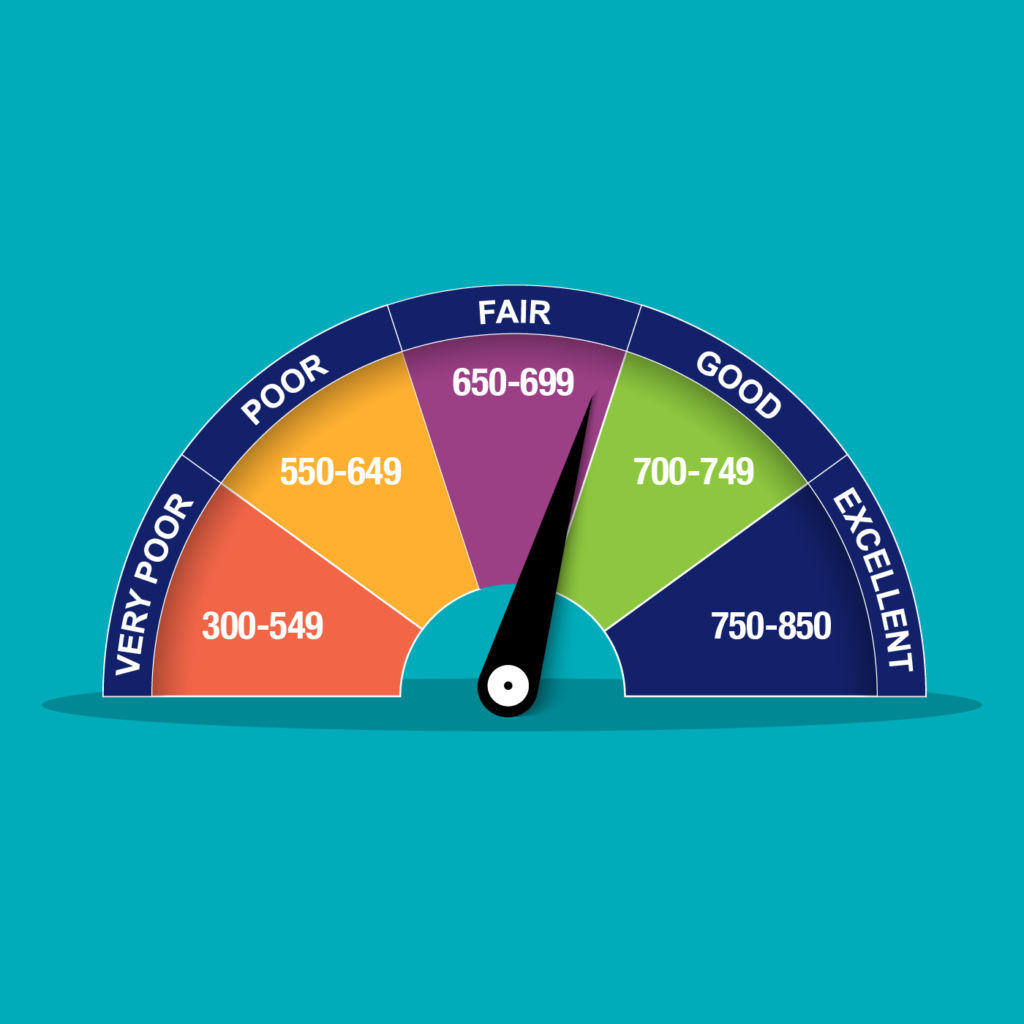

Credit scores typically range from 300 to 850, with 850 which is the highest credit score indicating a lower risk of default.

A person with a good credit score is more likely to pay back a loan facility extended to him than a person with a bad credit score.

FICO and VantageScore are the two biggest credit scoring models.

Factors Use to Calculate Credit Score

The following are the factors that affect your credit score.

- Payment History: This is the most important factor in calculating your credit score. Whether you’ve paid your bills on time, any missed or late payments and any history of default or bankruptcy are considered at this stage.

- Credit Utilization: The percentage of credit you spend from the credit line extended to you is also very important in calculating your credit score. It is mostly considered that a lower utilization of below 30% is the most favorable.

- Length of Credit History: The length of your credit account is also a very important factor. Those with a longer credit history are of an advantage over those who just started building their credit not long ago.

- Types of Credit: The types of credit you have also count. The mix of different types of credit accounts you have, such as credit cards, mortgages, and installment loans. Having a diverse mix can be beneficial.

- New Credit: The number of new credit accounts or credit inquiries you have made or opened is also very critical. Opening multiple new credit accounts within a short period of time may be seen as risky behavior and will impact negatively your credit score.

More Contents on Credit Score

The Complete Guide to Understanding Credit Scores

Why Having a Good Credit Score Is Important

Why There Are Different Credit Scores

What Affects Your Credit Scores?

How Do I Improve My Credit Score?

Where Can I See My Credit Score?

What Credit Score Do I Need to Buy a Car?

Can You Get a Car With Bad Credit?

What Credit Score Do I Need to Get a Good Deal on a Car?

Why Is a Credit Score Important When Buying a Car?

What to Do if You Don’t Have a Credit Score

Monitor Your Credit Report and Score

It is important to note that a higher credit score is a positive indication and makes it easier to qualify for credit such as loans, mortgages, and credit cards with favorable terms and lower interest rates.

It is important to review your credit report for any errors. If you find an error, you can dispute it with the credit bureau. Keeping a good credit score is ultimately very important because it makes access to credit very easy.

How To Improve Your Credit Score

There are a number of things you can do to improve your credit score, such as:

- Make your payments on time.

- Pay down your debt.

- Increase the length of your credit history.

- Get a variety of credit accounts.

- Limit the number of inquiries on your credit report.

By taking these steps, you can improve your credit score and qualify for better loan terms.