When it comes to determining your creditworthiness, the word “VantageScore” is frequently used in conjunction with the more familiar FICO score.

But what is a “good” VantageScore, and why is it important? VantageScore is an impartial credit score provider used by credit card issuers and lenders to rate loan or credit applications.

What Is a Good VantageScore?

It was formed in 2006 by Equifax, Experian, and TransUnion. Its scores range from 661 to 780 and are divided into five categories.

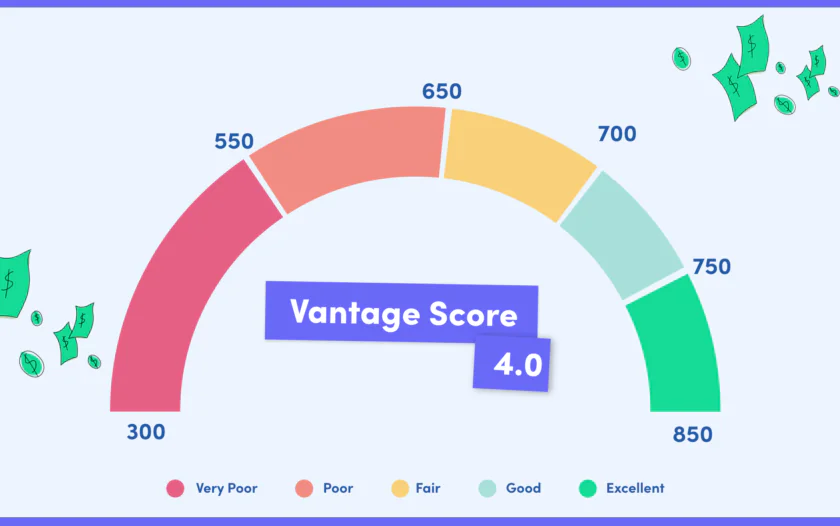

It’s calculated based on the information in your credit report and helps lenders assess the risk of lending you money. VantageScores typically range from 300 to 850, and they’re often categorized as follows:

Poor (300-499) scores are high risk and difficult to secure credit with favorable terms.

Fair (500-600) may qualify but may face higher interest rates.

Good (601-660) scores offer better loan terms and competitive rates.

Very Good (661-780) scores are favorable to lenders, offering lower interest rates and more financing options.

Excellent (781-850) scores offer the best loan terms and lowest interest rates.

The Significance of a Good VantageScore

So, why does your VantageScore matter, and why should you aim for a “good” one?

Your VantageScore is crucial for loan approval, interest rates, credit card offers, renting an apartment, and insurance premiums.

A good score increases your chances of approval, lowers interest rates, and helps credit card issuers make better offers.

It also helps landlords assess your financial responsibility and secures desired rental properties. Additionally, a good score may result in lower insurance premiums, as insurance companies use it to calculate premiums.

More Contents on Credit Score

The Complete Guide to Understanding Credit Scores

Why Having a Good Credit Score Is Important

Why There Are Different Credit Scores

What Affects Your Credit Scores?

How Do I Improve My Credit Score?

Where Can I See My Credit Score?

What Credit Score Do I Need to Buy a Car?

Can You Get a Car With Bad Credit?

What Credit Score Do I Need to Get a Good Deal on a Car?

Why Is a Credit Score Important When Buying a Car?

What to Do if You Don’t Have a Credit Score

Monitor Your Credit Report and Score

How to get a Good VantageScore

Improving your VantageScore or maintaining a good one takes time and responsible financial management. Here are some tips:

Pay your bills on time consistently.

Keep your credit card balances low relative to your credit limits.

Avoid opening too many new credit accounts at once.

Keep old accounts open to maintain a longer credit history.

Review your credit reports for errors and dispute any inaccuracies.

In conclusion, aiming for a high score can lead to better financial prospects, reduced interest rates, and a smoother road to your financial goals.

Consider your VantageScore a valuable commodity to be nurtured intelligently in order to open the doors to a brighter financial future.